Today, the UK’s building society industry includes 43 institutions holding an aggregate £333 billion in savings for 23 million members.[1] They’re helping more than 3.6 million families and individuals buy their own homes with mortgage advances totalling £357 billion. According to the Building Societies Association, in 2021 alone building society savers received £615 million more in interest than they would have got at big banks.

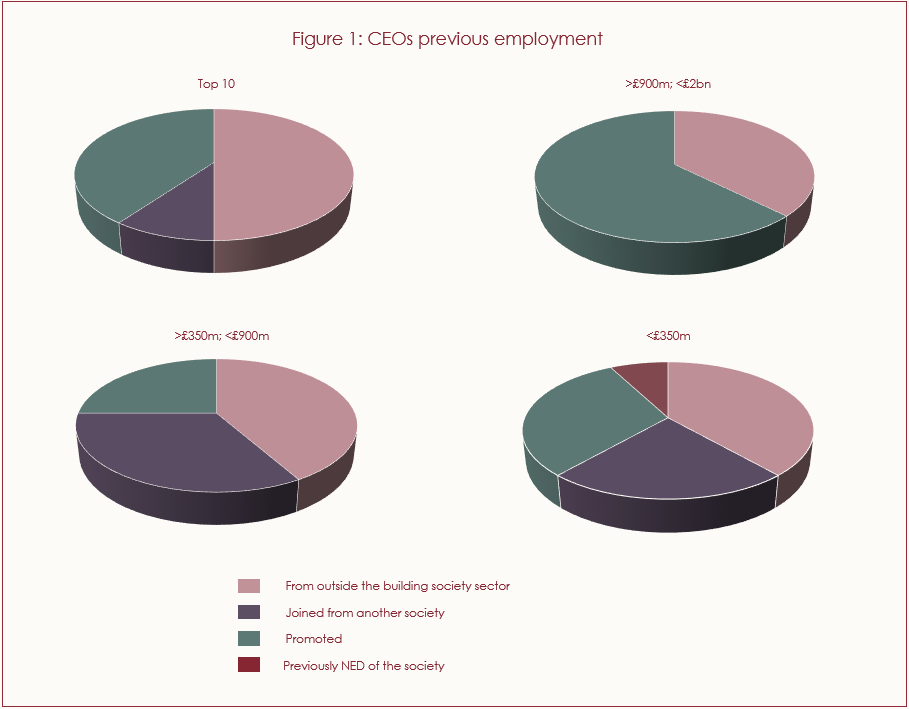

When considering the impressive figures, it becomes evident that leadership plays a pivotal role in the success of building societies, not only within the UK’s financial and housing systems but also in its society at large. Building societies serve as crucial organisations, and finding the right leadership talent becomes essential in navigating through turbulent times and consistently delivering for customers. Interestingly, the largest building societies adopt a strategic approach, as they recruit 50% of their leadership from outside their own sector. This deliberate decision brings in a fresh infusion of talent and innovative thinking, enabling them to continuously innovate and progress.

For the last few , we’ve produced an annual research study that examines trends in CEO recruitment and succession across UK retail banking, SME banking, insurance and wealth management. In the edition we published earlier this year, we noted that all four CEO changes announced at Top 10 building societies had seen the appointment of CEOs who had established their careers in mainstream retail banking. These were:

- Debbie Crosbie (Nationwide Building Society) – from TSB and, previously, CYBG/Virgin Money

- Susan Allen (Yorkshire Building Society) – from Barclays and, previously, Santander UK and RBS

- Stuart Haire (Skipton Building Society) – from HSBC and, previously, RBS

- Sue Hayes (Nottingham Building Society) – from GB Bank and, previously, Aldermore, Barclays and Santander.

Building on this insight, we’ve analysed the trends in CEO appointment across all 43 building societies active at the time of publication.[2] To help focus our research, we segmented the societies by size into four groups:

- Top 10, all with mortgage assets of more than £2bn

- Societies with mortgage assets of between £900m and £2bn (8 societies)

- Societies with mortgage assets of between £350m and £900m (12 societies)

- Societies with mortgage assets of less than £350m (13 societies).

Across the sector, we found that 25.6% of societies changed CEO during 2022. We also uncovered significant variances in CEO appointment patterns between societies in the different sizing bands.

Top 10 societies: widening the net for leadership talent

Exactly 50% of the current CEOs at Top 10 societies were appointed from organisations outside the building society sector. In no other segment have a higher proportion of CEOs been appointed from outside. In addition to the four CEOs highlighted above, Des Moore, CEO of Cumberland since April 2018, was leading AIB UK’s Northern Ireland business before stepping into his current role.

It’s also noteworthy that Richard Fearon (Leeds) and Andrew Haigh (Newcastle) both held business/P&L leadership responsibilities outside the sector – at Lloyds Banking Group and Engage Mutual respectively – before joining the societies where they now work.

Why do so many of the UK’s biggest building societies seek leadership talent in other sectors?

Building societies have history, tradition and long-standing customer service in place against which some banks struggle to compete. That’s why it’s often claimed that achieving Consumer Duty compliance – a cornerstone of the FCA’s three-year strategy – will prove a tougher challenge for most banks than it will for building societies.

That said, it’s easy to assume that some of the larger societies see themselves effectively as ‘mutual banks’, and therefore regard high street banks and so-called challengers as their primary competition. Meanwhile, in the move towards greater commercialisation, significant progress has been made by the larger societies. This has led to impressive growth – with Yorkshire and Leeds leading the way in terms of year-on-year total asset increases, at 10% and 9.1% respectively.

A further trend continuing is rapid digitisation. Covid-19 forced fundamental operating model changes on UK financial services, including building societies. During and after the pandemic, the banking sector’s response has accelerated the pace of digitisation in the broadest sense – including the introduction of mobile apps, digital IDs, cloud-based solutions and API connectivity, as well as developments in cyber security.

As the digital advance continues, most societies still have a long way to go to compete effectively in the digital space, especially against the digital-first banks like Starling, Monzo and Atom. What’s more, the resources at the disposal of the high street banks far exceed those of all societies (other than Nationwide). It’s little surprise then that mainstream banking is ahead of the building society sector on the digitisation journey.

All of this helps to explain why, when faced with undertaking a CEO succession, the Boards of Top 10 building societies encourage their Search partners to compile Longlists that include candidates from mainstream banking. Whether they have operated previously in CEO or divisional MD-type roles, these candidates can bring attractive commerciality and a strategic breadth of perspective – often from having been responsible for a broader proposition set than that offered by a traditional building society.

There are benefits the other way too. For a divisional MD or other P&L leader at a mainstream bank, the opportunity to move to a large building society may be regarded as a short-cut to a leadership role – a faster-track route to meaningful, end-to-end CEO responsibilities than if they remained with their current employer.

In addition, in the wake of the global financial crisis, societal changes have made the idea of working at a mutual, purpose-led business with an unswerving focus on doing the right thing for customers increasingly attractive from a cultural perspective. Making the switch needn’t mean taking a big financial hit: while building societies don’t compete with mainstream banks and PE-backed challengers with respect to long-term and management incentive plans, the drive for modernisation has – in most cases – also led to increased CEO remuneration packages.

Societies with assets between £900m and £2bn: a blend of challenges and strengths

No societies in this segment have a CEO who joined directly from another building society, and half of them have a CEO who was promoted from a CFO or Finance Director role.[3] The exception is Phillippa Cardno (Newbury), who was promoted from Operations and Sales Director in March 2022.

Like the Top 10, these medium-sized societies know that being unable to offer digital solutions to their customers would be a huge strategic mistake in the long term. It’s imperative that they generate the value required to digitise their operations and offerings. Most have opted to do so by driving growth rather than by leveraging free capital. Given this focus, the fact that many have promoted an internal candidate to the CEO role should not be regarded as a lack of ambition.

The tendency to promote internally reflects the specific pressures facing this segment of societies

In general, building societies are businesses for whom people are proud to work. Nevertheless, for medium-sized societies, attracting proven leaders from mainstream banking remains a challenge. To lead a mutual, some people working in banking might be prepared to take a sideways step in terms of compensation – but most wouldn’t consider moving backwards financially.

In this context, it’s interesting to note the backgrounds of those CEOs who joined their current society from outside:

- Mark Bogard (Family) – joined in 2012 having, previously, been CEO at wealth manager IFG Group.

- Andrew Healy (Leek United) – joined in 2018 having, previously, been CEO at Bank of Maldives.

- Chris Harrison (Furness) – joined in 2017 having, previously, been President and CEO, Europe at general insurer Assurant.

Despite external CEO recruitment being problematic for societies of this size, they also have some strengths. Unlike some of the smaller players, medium-sized societies have the scale, resources and organisational complexity needed to apply real strategic focus to their CEO succession planning. Average year-on-year growth in total assets across this segment has been strong, with Newbury, for example, increasing its assets by 13.57% in the last year – suggesting that their succession planning has been working effectively.

Societies with assets between £350m and £900m: the highest share of in-sector appointments

At 33.3%, this segment has the largest percentage of building societies led by CEOs who were serving on the Board of another society immediately prior to their appointment. Namely, these CEOs are:

- Colin Fyfe (Hinckley & Rugby) – had been Darlington’s CEO for the previous four-and-a-half years.

- Andrew Craddock (Darlington) – replaced Colin Fyfe, having been Buckinghamshire’s CEO for four years.

- Simon Taylor (The Melton) – CEO from June 2020, having served on the Board of Nottingham as Chief Operating Officer for nearly eight years.

- Iain Kirkpatrick (Market Harborough) – joined from Nottingham, where he was Chief Customer Officer for nearly two years.

All four of the CEOs listed above gained significant experience of mainstream banking before joining the building society sector. Colin Fyfe had a progressive 25+ year career with Clydesdale Bank/CYBG; Andrew Craddock was with AIB UK (and, before that, Barclays); Simon Taylor spent eight years with Lloyds TSB after an earlier career with Barclays; and Iain Kirkpatrick was with Halifax/Lloyds Banking Group and then Metro Bank. In this segment, CEOs who joined their current societies from outside the sector include Richard Norrington (Suffolk), Paul Denton (Scottish), Mark Selby (Hanley Economic), Alun Williams (Swansea) and, more recently, James Paterson (Dudley).

Societies with assets below £350m: the most balanced spread of backgrounds

The segment comprised of the smallest building societies (by mortgage assets) exhibits the most balanced spread of CEO backgrounds. Almost two in five (38.4%) of the CEOs in this segment were appointed from outside the building society sector, 23.2% joined from other building societies, and 30.7% were promoted internally, all from CFO roles (or similar). There is even a CEO – Richard Doe (Harpenden) – who had previously been a Non-Executive Director at the society he now leads. This segment saw four new CEOs appointed during 2022, representing a relatively high 30.1% rate of CEO churn. Namely, these are:

- Dan Wass (Buckinghamshire) – previously Director of Member Propositions at Nationwide

- Steven Jones (Stafford Railway) – promoted from Deputy CEO and Finance Director

- Gareth Griffiths (Ecology) – previously Head of Retail Banking at Triodos Bank

- Janet Bedford (Beverley) – promoted from Deputy CFO and Finance Director

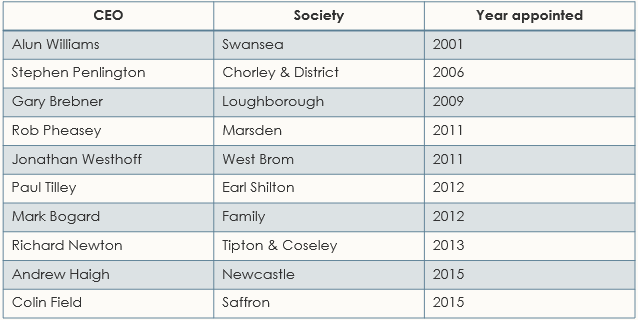

Staying the course: the longest-serving building society CEOs

Role before CEO promotion: CFOs in the frame

An analysis of CEO appointments in societies across all the size categories reveals some interesting sector-wide statistics. For example, 37.2% of all building society CEOs were promoted to their current role – including four CEOs at Top 10 societies, five from medium-sized societies (with mortgage assets between £900m and £2bn) and seven from societies with less than £900m in assets. Of these, eleven CEOs were promoted from CFO or Finance Director, with the remainder from Chief Commercial/Customer Officer or COO-type roles. The fact that 25.6% of current building society CEOs have been promoted from CFO (or similar) is especially telling, being a very high percentage when compared with the broader UK financial services market. As we highlighted in annual latest CEO Succession Trends report, just 13% of CEOs across banking, insurance and wealth management were promoted from CFO.

Several factors at play here. Given the highly regulated nature of UK financial services, Boards can feel pressured to conduct a comprehensive market search when replacing their CEO. Regardless of how effectively reputations and relationships with the Board have been built, a serving CFO might find themselves considered to be left field when a Shortlist of candidates with impressive business leadership credentials is presented. Of course, this perception will be mitigated if the CFO has gained P&L leadership experience or has had the opportunity to serve as Deputy CEO, as was the case for several of the building society CFOs who have been promoted. Taking on an external non-executive directorship can also help to offset a lack of previous P&L leadership experience: a CFO’s reputation can be enhanced by serving as an iNED, strengthening their credibility and, therefore, promotion prospects.

Diversity, Equity & Inclusion: solid progress – but further to go

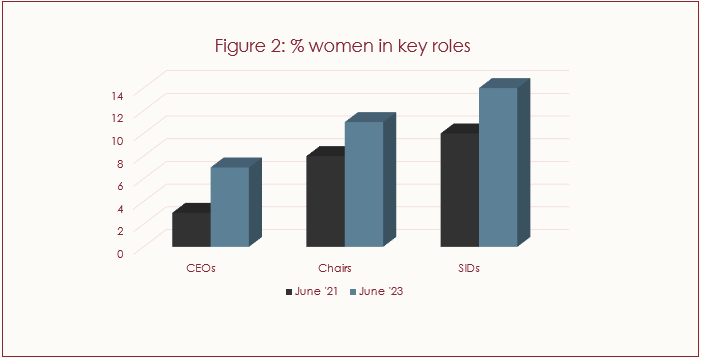

We believe that fostering a diverse and inclusive culture is key to the long-term success of any business – and that having a workforce that more accurately mirrors a diverse customer base enables a better response to those customers’ ever-changing needs. With these benefits in mind, we published a Building Society Board Diversity report in June 2021

showing that the gender diversity of building societies’ Boards compared favourably to that of the Boards of listed businesses – with 43.2% of all building society Non-Executive Directors being women.

Our study also reported that, at the time, just three building societies employed women Chief Executives; 17% of all Executive Directors were women; eight societies had women Chairs; and 10 societies had a woman serving as Senior Independent Director. In the two years since publishing those figures, building societies have made further progress in terms of female representation at senior levels, as shown below:

Today, the building society sector employs seven women CEOs (with five having been appointed in 2022), 12 women Chairs and 14 women SIDs. Special mention must be given to the Principality and Beverley building societies, where both the Chair and CEO are women, and to Leek, Melton & Bath, where both the Chair and SID are women. Until relatively recently the diversity agenda has focused almost exclusively on gender – it’s now extending to further dimensions. In 2015 the Parker Review, chaired by Sir John Parker, was commissioned by the Department of Business, Energy & Industrial Strategy (BEIS) to consult on the ethnic diversity of UK Boards. Consequently, progress is now being made towards increased ethnic minority representation. However, one group that has not yet been as visible on corporate Boards’ succession radar is the LGBTQ+ community. In time, that will change – and to keep mirroring their customer base, building societies and other financial services firms should start taking appropriate steps today. The reality is that Diversity, Equity & Inclusion is a journey where there’s always further to go.

About Redgrave Financial Services

Redgrave is global search firm focused on building long-term trusted relationships that go beyond delivery. Our Financial Services practice operates across retail, SME banking, insurance and wealth management. We advise clients on a range of CEO and CFO roles, and help leaders transition from executive to non-executive careers.

To remain competitive, building societies should partner with Search firms who will look beyond the building society markets, for example, to span the whole consumer-focused financial services market.

Given the distinctive attributes that we bring to every engagement, it’s no surprise that Redgrave outperforms the market on DE&I objectives substantially. Year-on-year since 2020, more than two-thirds of all appointments made by our Financial Services practice were either women or from minority ethnic groups.

To learn more about how our Financial Services practice is helping clients with their leadership challenges, contact Conrad Hills.

[1] Source: https://www.bsa.org.uk/BSA/files/40/4012c7d9-b417-4b2e-8a05-50ba07df0264.pdf

[2] The merger between Newcastle and Manchester building societies has been agreed, and will become effective on 1st July 2023.

[3] This includes the recent announcement that Michael Boyd (Progressive) is stepping-up to replace Darina Armstrong, who was also promoted to CEO having been Finance Director.